Denver household incomes need to be $71K higher than 2020 to afford a home

THE GAZETTE FILE

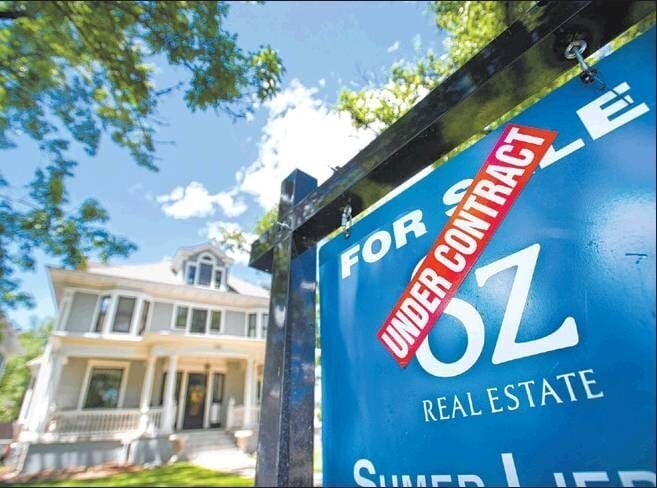

It’s no secret buying a house has become much more expensive since the pandemic. But how much more does one have to earn to afford a mortgage?

Households in Denver would need their incomes to go up more than $71,000 since 2020 to afford a monthly mortgage with a 10% down payment, according to an analysis from real estate company Zillow.

It would require $172,700 a year to buy a home without spending over a third of the income on mortgage payments to be considered affordable.

That’s higher than the national average, as U.S. households would need to see their income go up $47,000 over the four years.

Denver has the 9th-highest income needed to afford a home out of the nation’s biggest metros, according to Zillow.

Housing prices, mortgage rates and rent have outpaced wage growth since the pandemic, Zillow economist Orphe Divounguy said in a statement.

In Denver, the average home sold for $667,000 in February, according to the Denver Metro Association of Realtors. At the same time in 2020 — the last full month before pandemic shutdowns spread across the U.S. — the average home in the metro cost $482,000.

“Buyers are getting creative to make a purchase pencil out, and long-distance movers are targeting less expensive and less competitive metros,” Divounguy said. “Mortgage rates easing down has helped some, but the key to improving affordability long term is to build more homes.”

Mortgage payments across the nation have nearly doubled since 2020, according to Zillow.

The average Denver homeowner pays $3,600 a month for a mortgage, Zillow found.

And it takes nearly 11 years to save up for a 10% down payment.

Colorado’s competitiveness for housing affordability ranked dead last among states and the District of Columbia in 2023, according to the Common Sense Institute, a nonprofit research firm studying Colorado’s economy.

It’s hurting the state’s overall economic competitiveness and new housing supply isn’t being added fast enough, contributing to rising prices, the CSI study noted.

In 2013, Denver homeowners would need to work 42 hours a week at the average hourly wage to afford a home, CSI found.

Now, it would take nearly 114 hours.