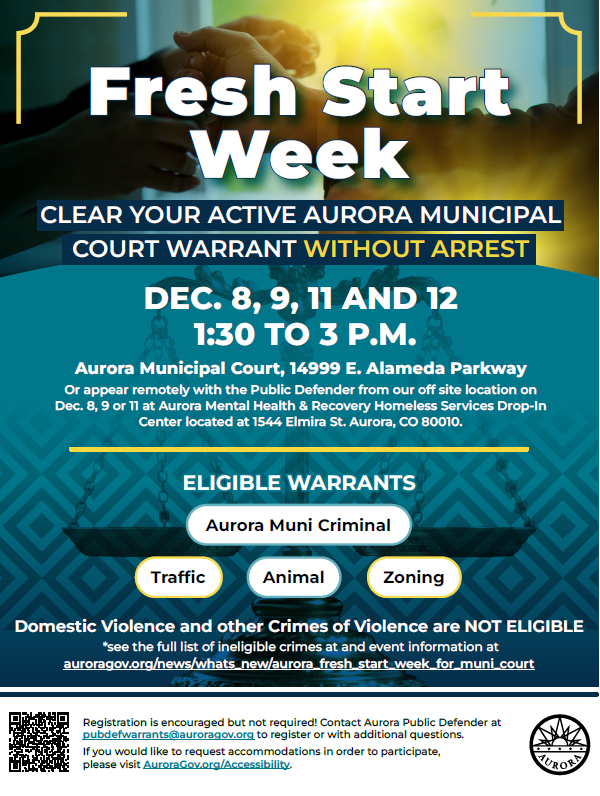

Appeals court rules employers cannot deduct their own business costs from employee wages

Rebecca Slezak

Colorado’s second-highest court ruled on Thursday that employers cannot deduct from employees’ wages any costs that are “inherent in the job,” and any work agreements allowing for such an arrangement are unlawful.

In the case at hand, Elora Buenger worked as a cosmetologist for 303 Beauty Bar LLC, also known as 303 Salon Lohi. She received a commission for products and services that she sold. Her agreement also stipulated that 303 Salon Lohi would deduct the costs of products Buenger used at work from her paycheck.

In 2022, Buenger filed a complaint with the Colorado Division of Labor Standards and Statistics. Among other challenged practices, her employer had deducted roughly $12,000 from her paychecks in 2021 and 2022 for hair products. The division determined state law did not permit 303 Salon Lohi to do so, as Buenger’s services at the salon were for the benefit of her employer.

On appeal, an administrative law judge agreed 303 Salon Lohi owed Buenger $7,500 in unpaid wages, as well as $10,773 in penalties for the unlawful wage deductions.

303 Salon Lohi then sought judicial review. In a March 2024 order, then-Denver District Court Juge David H. Goldberg determined the law in question was ambiguous. It prevented employers from making deductions from employees’ wages, but a deduction for employer-provided equipment or property is acceptable “pursuant to a written agreement” and so long as it is “not in violation of law.”

Goldberg noted the purpose of the Colorado Wage Claim Act is to protect employees form “exploitation, fraud, and oppression.” The division’s interpretation of the law as forbidding wage deductions in Bruenger’s case — even with the employment agreement — was reasonable because the “products at issue are those used directly by Employee in performing services for customers, for the ultimate benefit of Employer,” Goldberg wrote.

Once again 303 Salon Lohi appealed, arguing it relied on a “historical practice in the salon industry” of providing products to hair stylists for their benefit. It also maintained Buenger’s pay never fell below minimum wage as a result of the deductions and Buenger had even acknowledged the hair products she used on her clients served to grow her clientele base.

A three-judge panel for the Court of Appeals agreed the law was ambiguous, but Buenger’s work agreement that shifted the “employer’s costs of doing business onto her” was “precisely the type of exploitation the Wage Act is intended to prevent.”

“The salon’s business is providing beauty services to its customers. It employs cosmetologists who are required to use the salon’s products to provide those services,” wrote Judge Neeti V. Pawar in the Feb. 20 opinion. “Adopting the salon’s reasoning would allow an employer to deduct from an employee’s wages any costs that are inherent in the job — for example, the cost of drafting paper for an architect or polish for a dental hygienist — simply because the employee may receive an incidental benefit from the mere fact of being employed.

“We cannot conclude that the legislature intended such a result,” she added.

Pawar noted that since Buenger’s original agreement with 303 Salon Lohi, the division published an opinion making clear that an employer can only dock an employee’s wages when it provides things “for the employee’s benefit.” But because the opinion was not binding law, the Court of Appeals did not rely upon it in its analysis.

The case is 303 Beauty Bar LLC v. Division of Labor Standards and Statistics.