Don’t feed the higher ed ‘beast’ — with a mandate | Jimmy Sengenberger

Young Americans’ financial literacy is at historic lows, so requiring high school students to take a financial literacy course before graduating makes sense. School is about preparing kids for the future, and what better way than teaching skills to handle money responsibly?

That’s part of what House Bill 25-1192 aims to do, with bipartisan sponsorship. Unfortunately, as with many things, lawmakers didn’t stop there. They’ve added a problematic requirement that could harm the very students they’re trying to help — mandating seniors complete the Free Application for Federal Student Aid (FAFSA) or its state equivalent to receive their diploma. There’s an “opt-out,” but the default is required participation.

The bill’s authors say this will help students understand how to finance higher education and plan for the future. It’s a nice idea, in theory: We want graduates to know their options, but making the notoriously complex FAFSA mandatory perpetuates a broken system while ignoring seismic shifts in higher education.

In a 2017 paper for my former Millennial Policy Center, I called for abolishing the FAFSA altogether — arguing its financial demands create an “intimidating barrier,” especially for families who need aid the most, citing research from the Center for College Affordability and Productivity. Despite Congress’s FAFSA “simplification” — made effective last fall in a widely criticized, botched rollout — it remains a complex maze. Sure, it now pulls tax data directly from the IRS, but families still face roughly 20 pages prying into income, investments, assets and business holdings.

This invasive data collection lets colleges practice price discrimination — using families’ private finances to set arbitrary prices and manipulate merit-based aid. The reforms’ cosmetic changes — like modifying the Expected Family Contribution to a Student Aid Index — did nothing to stop institutions from maximizing what each family pays.

More importantly, even after completing this lengthy and often confusing application, families still don’t have a clearer picture how to pay for college — only learning their aid eligibility AFTER getting into a school and often leaving them in the dark when making big decisions.

Let’s be clear: These flaws make Colorado’s proposed mandate a mistake waiting to happen. Instead of pushing Congress to fix or scrap this broken system, lawmakers want to make it a graduation requirement. Why should the state track whether a student requests financial aid anyway?

While completion rates have declined nationally, including among minority and lower-income students, the handful of states that currently mandate the FAFSA show higher rates, boosting the national average. But these improved numbers mask a troubling reality: If students file paperwork only to get their diplomas, with no college plans, we’re creating new barriers to graduation while ignoring genuine obstacles to higher education access.

It’s like the graduation illusion. Denver Public Schools recently touted a “record” 79.9% graduation rate, yet nearly half their highschoolers aren’t proficient in English, and 70% fall short in math. Receiving a diploma without meeting expectations won’t prepare students for college or career — it will set them up to fail. The same goes for mandating FAFSA without tackling underlying affordability issues or students going to college.

Here’s the thing: This misguided push comes as traditional college enrollment patterns are changing. The National Student Clearinghouse reports first-year enrollment has dropped 5.8% among recent high school grads and 8.6% among 19- to 20-year-olds. Meanwhile, it’s soaring for older students — up 20% for ages 25-29 and nearly 10% for those 30-plus. These numbers build on a clear trend: Post-pandemic higher education is increasingly driven by adult learners pursuing practical skills.

We’re witnessing a paradigm shift in higher education, driven by returning “stopped-out students” who previously left college without a degree. Their return, up 9.1% in 2022-2023, signals a deeper change. College isn’t just for fresh high school graduates anymore; it’s increasingly for adults seeking degrees — with more financial wisdom and capacity than they had at 18.

So why is Colorado pushing teens to file FAFSA documents that could ultimately saddle them with lifelong debt they may be unprepared to evaluate? The market is already moving from this outdated higher-ed model. Pandemic policies prompted students to rethink their educational goals, leading to modest declines in the average “net price” after decades of increases by forcing colleges and universities to check their prices and programs.

Unfortunately, this FAFSA mandate threatens to stifle that progress by reinforcing a flawed incentive structure that has long fueled surging student debt through proliferating loans and grants. Research shows for every dollar in Pell Grants and subsidized federal loans, colleges hike tuition by 55 cents and 65 cents, respectively — the “pass-through effect” documented by the New York Fed.

This well-intentioned mandate won’t just perpetuate a contorted system that must be abolished — it risks driving up costs while pressuring young people into potentially ill-advised financial commitments cloaked as accessing financial aid. The last thing legislators should do is make things worse under the pretense of helping kids afford college.

Let’s be real: Market forces are nudging higher education toward affordability and flexibility, however slowly. But this FAFSA mandate would drag us backward — throwing yet another lifeline to Colorado’s legacy university system, not the students it’s supposed to help. When CU and CSU keep hiking tuition by 3-4% annually, bucking national trends, why should lawmakers compel students into feeding the beast?

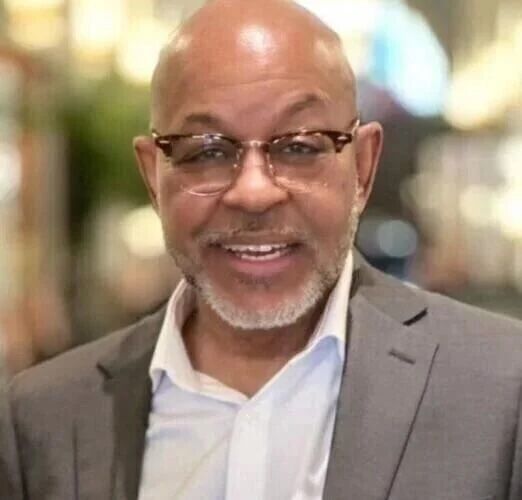

Jimmy Sengenberger is an investigative journalist, public speaker, and longtime local talk-radio host. Reach Jimmy online at Jimmysengenberger.com or on X (formerly Twitter) @SengCenter.