Colorado’s TABOR-exempt revenue has increased nearly 30% since 1996, study finds

State spending that is exempt from Colorado’s Taxpayer’s Bill of Rights has increased by nearly 30% over the past 30 years, according to a report by the public policy think tank Common Sense Institute.

While TABOR places a limit on how much revenue the state can retain each fiscal year, certain sources — such as voter-approved changes, federal funds, and state enterprises — are exempt.

According to the Bell Policy Center, enterprise funds are state-owned “businesses” that provide goods or services in exchange for revenue. Examples include the state lottery and the Colorado Healthcare Affordability and Sustainability Enterprise (CHASE).

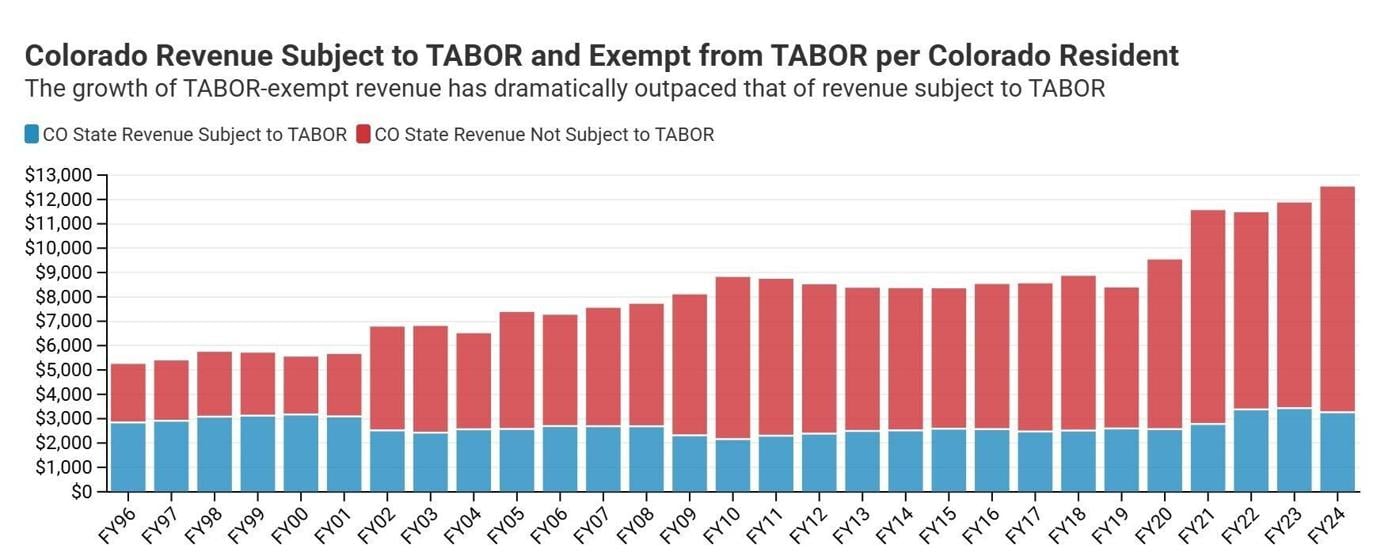

According to the Common Sense Institute report, 46% of total state spending — about $5,264 per resident — was exempt from TABOR in 1996. By fiscal year 2024, 74% of the state’s revenue was now exempt from TABOR — just over $9,000 per Coloradan.

In 2020, voters approved Proposition 117, which requires voter approval to establish enterprises expected to generate more than $100 million in revenue within their first five years.

Since then, the state has created 10 new enterprises, costing Coloradans more than $124 million.

Additionally, four new laws passed during the 2024 and 2025 sessions are set to take effect soon and are projected to generate more than $300 million in TABOR-exempt state revenue.

The report also found that revenue from enterprise fees has grown from $742 million in Fiscal Year 1994 to nearly $26 billion in Fiscal Year 2024, a 3,369% increase.

Colorado’s higher education enterprises, which include most of the state’s public colleges and universities, have consistently brought in the most TABOR-exempt revenue, growing from $360 million in FY 1994 to over $15 billion in FY 2024.

Unemployment compensation, CHASE, and the CollegeInvest program also each generated over $1 billion in TABOR-exempt revenue last fiscal year.

The report said the total amount of TABOR-exempt revenue collected by enterprises per Colorado resident has more than tripled since 2008, and fee revenue grew “substantially faster” than revenue to the state’s general fund, which supports services like roads and transportation, courts and prisons, and K-12 education.

State revenue from enterprises and the General Fund per Colorado resident since 2000. Courtesy Common Sense Institute.

“The more that fee increases assume the character of tax increases, especially in the aftermath of Proposition 117, the more appropriate it becomes to characterize them as such,” wrote the study’s authors, Erik Gamm and Judah Weir, adding that fee revenue growth is driving Colorado’s “tax burdens” without giving citizens a say in the process.