Current Events Only Raise Uncertainty

Every investor I’ve met has, at some point, asked a version of this question: “Given what’s going on right now, what should I do?”

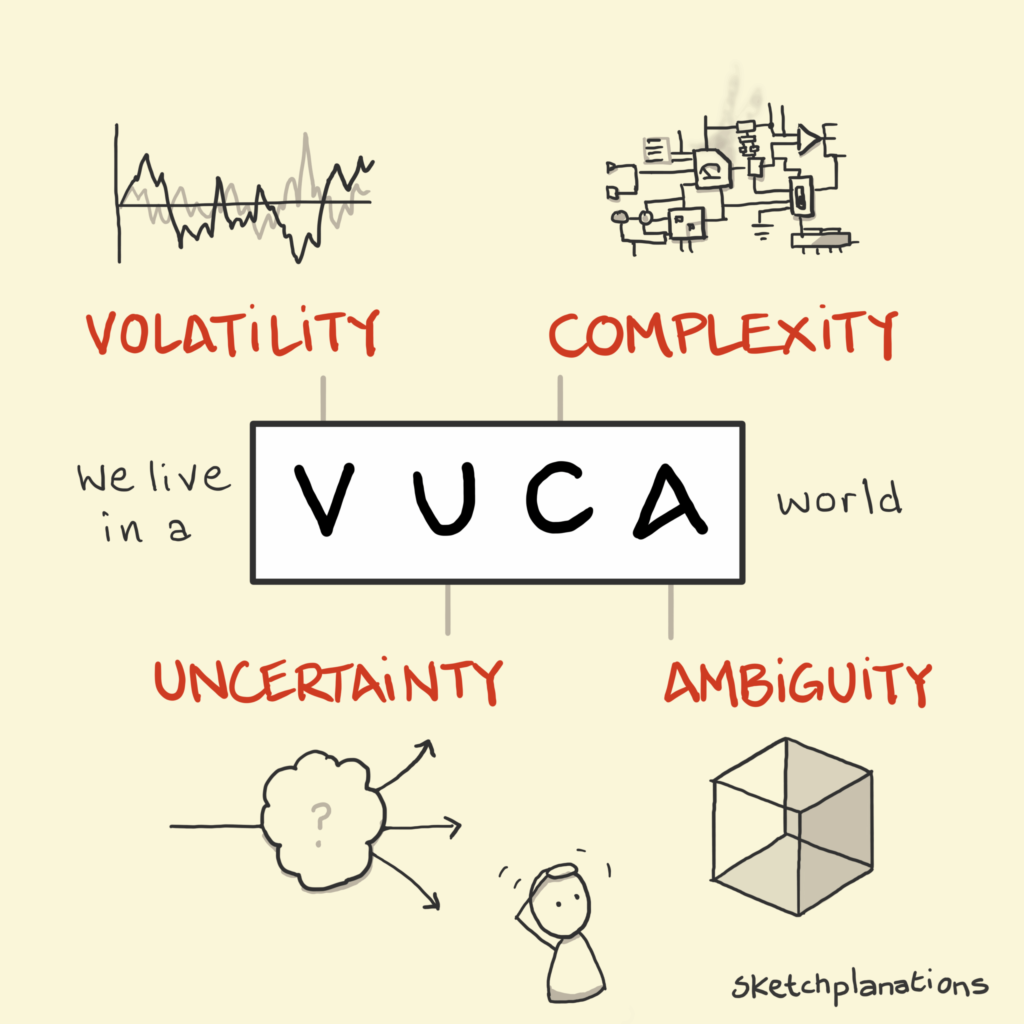

As a financial advisor, I always consider this a reasonable thought. The world is unpredictable: Wars flare up, elections divide, inflation gets sticky, interest rates go up and down, markets swing, and “Breaking News Alerts” clog your screens. Each new event seems to be urgent and demanding of a response.

If there’s one thing I’ve learned over the years, however, it’s that current events never help us understand the future. They only raise uncertainty and create doubt, both of which are hallmarks of bad investment behavior.

Every market cycle has its narrative. Whatever the story, it’s wrapped in fear, urgency and conviction that this time is different. Even if the event feels strikingly similar, something “new” always makes people feel uneasy.

But this storyline is never different; it only feels that way. The world is always complicated. There’s always something to worry about. Yet through all of history’s crises, investors consistently built wealth by owning shares of great businesses. Those who stay the course and ignore the noise see rewards, while those who react emotionally pay the price.

As a financial advisor, I often have a front-row seat to watch one of two parallel storylines play out.

Against our advice — and in rebellion to their long-term financial plans — I’ve watched clients panic and sell in reaction to a major event. In the coming months and years, they’re often burned by this decision. We encourage these clients to find another advisor, given that they refused to consider our guidance.

Alternatively, investors who show discipline, focus on what matters, and trust their plan often find long-term success. They design portfolios around their goals rather than the news cycle. Their plan works. Their strategy works. And as a result, they find peace in an increasingly chaotic world.

Remember this important and simple truth: We can never know what will happen tomorrow. And that’s fine, because frankly it won’t matter. No one can predict the short-term outcomes of economic or political events — not the experts on TV, not the economists with their charts, and not even the CEOs running the world’s biggest businesses. What matters is whether your portfolio and plan are built to work toward your goals. If they are, then reacting to the unknowable can be harmful.

A disciplined investor spends far less time worrying about what might happen and far more time focusing on what’s within their control: saving consistently, owning high-quality and dividend-paying companies, reinvesting income, and staying patient. This strategy isn’t about predicting but preparing.

Today’s headlines are unsettling, but they’ve always been that way. Every moment in history has brought some uncertainty:

In the 1940s, the word was at war.

In the 1970s, inflation soared and oil ran out.

In 2008, the global financial system nearly collapsed.

In 2020, the world shut down overnight.

Each event felt like “the end” — something completely different than anything preceding it. But each time, markets recovered and investors who stayed invested emerged wealthier than before.

The market doesn’t reward those who correctly guess the next crisis. It rewards those who understand that volatility is the cost of admission for long-term success.

The truth is that investment success comes with a price: the willingness to stay invested through discomfort. There’s no shortcut, no signal light that turns green when it’s “safe” to invest again. There’s only discipline, patience and belief in the power of ownership.

So the next time a headline rattles you, pause before asking, “What should I do?” and instead ask, “Has my plan changed?” If your goals are the same, your plan should be too. Ignore the noise. Focus on what endures: real businesses creating real value, and your ability to participate in that growth.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

Investing includes risks, including fluctuating prices and loss of principal.

About the author

Steve Booren is the Owner and Founder of Prosperion Financial Advisors, located in Greenwood Village, Colo. He is the author of “Blind Spots: The Mental Mistakes Investors Make” and “Intelligent Investing: Your Guide to a Growing Retirement Income” and a regular media columnist. (Download his books free for the month of December!) He was recently named a Barron’s Top Financial Advisor and recognized as a Forbes Top Wealth Advisor in Colorado.