Ski resort markets show signs of life as first snows arrive

As the first real snow of the season arrives in Colorado’s mountain resorts, real estate agents in ski towns are reporting a better market this fall than the one that brokers down the hill along the Front Range are seeing.

“There is healthy activity as both buyers and sellers adjust to new price realities,” said Summit County agent Dana Cottrell with Summit Resort Group, one of the regular reporters to the Colorado Association of Realtors and its monthly Market Trends report.

“It’s not a frenzy, but it’s far from frozen,” Cotrell added.

Burst of September sales

In Steamboat Springs, agents were shocked to see a burst of sales arrive at the first of September, following what had been a lackluster summer season.

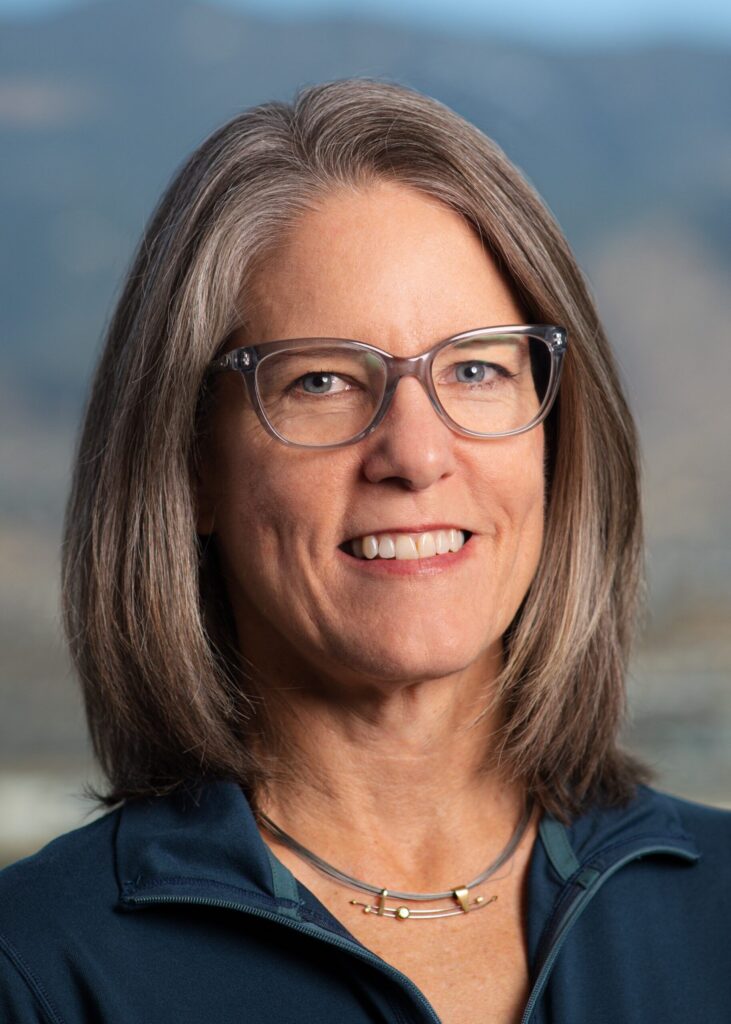

“The sales activity we usually see around July 1st really happened Sept. 1st,” Steamboat-area agent Marci Valicenti with The Group Real Estate told The Denver Gazette.

Pending sales in the town famous for its champagne powder jumped around 40% during September over the year previous, she said.

“It’s really strange,” she added. “We were busy this summer, but not contract busy. But, boy, did it happen in September.”

Berkshire Hathaway agent Mike Budd in Edwards, centered between Vail and Beaver Creek, said that several factors can tend to insulate the resort market, particularly its higher end, during a year when other residential sales are off.

Less impact from mortgage rates

“There are certainly excellent opportunities to buy and sell as the macro economy does not necessarily drive our market,” Budd reported in the new Market Trends report.

“We still sell most properties with cash purchases, so mortgage rates have less impact on the market activity,” Budd added.

“Typically, September and October are the months with the most closings in the Crested Butte–Gunnison area, and this year has proven to be on trend,” said Coldwell Banker agent Molly Eldridge, who tracks the market in Gunnison County.

“Overall, 2025 has been very similar to 2024, but September sales moved this year ahead of last year and October seems to be on track to help that continue,” she said.

“For September, dollar volume was up 73% and the number of sales were up 37%,” Eldridge reported, “not a surprise given the slow start to the summer and the activity we saw in late July and August.”

Grand County

Over the top of Berthoud Pass in Grand County, agent Monica Graves with eXp Luxury Division said that the latest data from Winter Park, Fraser and Tabernash have shown sizable gains in average sale price and sales volume tied to resort activity.

Reports on the markets in Granby and Grand Lake, further from Witner Park, were more mixed, she said.

Summit Resort Group’s Cottrell described the market around Keystone, Copper and Breckenridge as steady, bright and full of movement heading into snow season.

Single-family sales there jumped 42.9% last month over sales the year before, she reported. That was despite the median price continuing to rise — up 2.1% to $2,087,500, with the average price dipping slightly.

Condo and townhome sales

Cotrell said the price changes show continued strength, particularly in the luxury segment of the market, but with more balanced pricing overall.

Townhome and condo sales in the Summit County market climbed 26.6%, Cotrell said, with 100 homes sold and a median price rising 2.9% to $807,500.

On the luxury end, developers creating Kindred Resort at the base of Keystone were feeling that warmer market, sensing buyer interest at a moment when the snowmaking equipment fires up and opening days are pending.

New price threshold

“We’re 90% sold and in our final phase,” Amy Kemp with Kindred Resort told The Denver Gazette.

The project, with 95 luxury residences that form the core of a new village center opening from Keystone’s River Run gondola, marks a new pricing threshold not just in Keystone, but for all of Summit County, she said. Prices on remaining units are from the upper $2-million range to $5.35 million.

“Luxury seems to be outperforming the rest of the market, particularly in the resort areas,” Kemp added.

Doyle Richmond with LIV Sotheby’s International, co-broker on the Kindred project, told The Denver Gazette that the resale market in Summit County has a healthy feel despite a higher level of inventory. “There’s a want-to-sell feeling, but not a have-to-sell feeling,” he added.

“Keystone is a market that has always grown and has always been family oriented,” he said. “But people still want higher end experiences, and (the Kindred project) will elevate it.”

New construction projects

Some of the buyers, he reports, have resources to purchase in the very pricey markets farther west, but are choosing Summit for the proximity to Denver.

In Steamboat, Marci Valicenti said that new construction projects were similarly auguring well for the broader market. “We still have a lot of cash buyers and see a lot big sales,” she added.

She is working on the Crawford Square at Burgess Creek project, a boutique sized offering at the resort base a short walk from Ski Time Square, with prices starting at $6.75 million and ranging to $9.5 million.

The Colorado Association of Realtors represents some 23,000 members statewide.