Here’s how the sales tax in Denver works

What exactly is taxed in Denver?

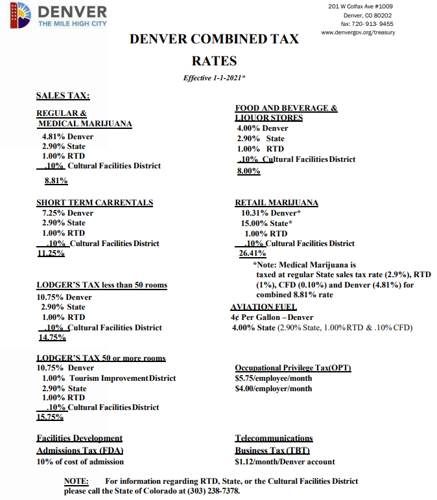

The City and County of Denver imposes a 4.81% sales tax on pretty much everything a consumer buys. Add to that regional and state taxes, and it all comes out to 8.81%.

Here are the additions: The state levies a 2.9% rate, the Regional Transportation District adds a 1% rate, and the Cultural Facilities District imposes a 0.1% rate.

If a pair of sales tax rate increases proposed by Mayor Mike Johnston and the City Council are approved by Denver voters this November, the Denver-only tax will spike to 5.65%, and, everything combined, Denver residents would pay a 9.65% sales tax on purchases — the highest rate in the metro area and northern Colorado.

That new tax rate would rival some of the sales taxes imposed by resort towns in the state.

There are exceptions and some special rules to Denver’s local sales tax rate.

Most digital products are subject to the tax, as are internet services and natural gas fees, according to the city’s tax information booklet.

But food, bought in certain settings, and other retail sales items are exempt.

Food and beverages, bought at a restaurant or pre-made at a grocery store, are not exempt from taxation and are assessed at a 4% rate, according to a city fact sheet.

“A limited exemption is provided for the sale of food for domestic household use,” the fact sheet says. “Some examples of taxable sales include prepared food and beverages sold by restaurants and grocery stores, catered food, coffee services, and liquor purchases.”

The city provides a list of food items it exempts from the sales tax, which includes virtually all day-to-day products a family would buy, such as meat, fruits, vegetables and baby formula. Water, except for carbonated drinks and “flavored water,” is exempt, as well.

Additionally, the city imposes a 10.31% tax rate on retail marijuana and marijuana product sales.

Notably, a 7.25% tax is collected on car rentals if the rental period is less than 30 days.

A state tax on alcohol is imposed based on the number gallons of liquor sold, scaling from 8 cents per gallon on beer to $2.28 per gallon for spirits.

Finally, pilots or airlines must pay a four-cent tax on aviation fuel.

But the sales tax isn’t the city’s only method for collecting revenues.

It also imposes a use tax, which is split into two types: The consumer use tax and a retailer’s use tax.

The consumer use tax is collected on certain items — furniture, equipment, fixtures and more — that are “used, stored or consumed within Denver.”

For example, if a company buys a machine made in Chicago and has it shipped to Denver to make a product, that company must pay Denver’s use tax of 4.81%.

“However, certain tangible personal property, which has been owned and used for its intended purpose for more than one year before it is moved into Denver, is exempt from use tax,” a city document noted. “That exemption does not apply to construction equipment, tools and machinery, construction building materials, and automotive vehicles.”

The retailer’s use tax is collected on retail sales from a “non-resident vendor” that delivers an item to Denver. So, if a company located in Greeley sells and delivers an item to a Denver address, the city’s 4.81% tax rate is imposed. This only appears to apply to items delivered into Denver by a vendor licensed to do business in the city, according to city documents.

For a car purchase, a resident pays the sales tax of whatever municipality his or her address is in. So, a resident of Lafayette pays that town’s sales tax, while a Denverite pays Denver’s taxes, regardless of where the vehicle is purchased.

Furthermore, a company buying something like building supplies will generally pay the tax where those supplies are purchased, according to the Department of Finance. However, if a sales tax was not assessed when those materials were bought, the buyer must pay the combined Denver and state sales tax on the items.

In short, the retailer’s use tax is the same as the sales tax, but only applies to businesses outside of Denver doing business in the city.

All of these taxes add up to generate more than half of the city’s general fund revenue.