Tag: Taxes

-

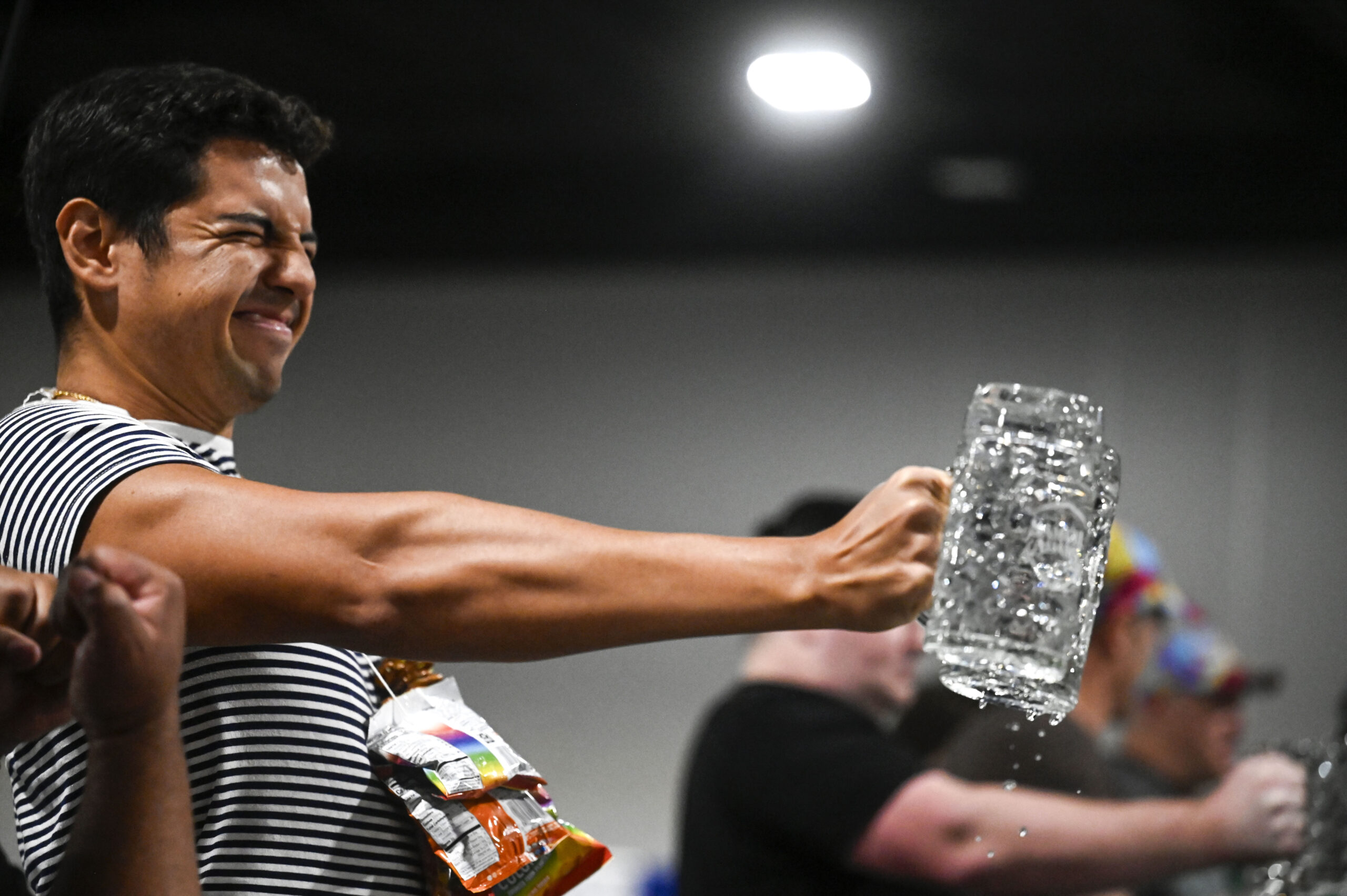

Lawmakers propose raising excise taxes on alcohol, marijuana to fund mental health spending

Colorado lawmakers hope to refer a measure to the November ballot that would increase excise taxes on alcohol and marijuana, with the revenue going toward mental health and civil commitment facilities around the state. House Bill 1301, sponsored by Rep. Bob Marshall, D-Highlands Ranch, and Sen. Judy Amabile, D-Boulder, would impose sales tax increases of…

-

Democrats want to decouple Colorado from federal tax breaks

Democratic members of Colorado’s House and Senate on Tuesday announced the introduction of a slew of bills that would reduce corporate tax deductions and sever Colorado’s tax regime from recent federal changes to the tax code. The federal tax changes provide hundreds of millions dollars in tax breaks. Since Colorado conforms to the federal tax…

-

GUEST COLUMN: Let’s be grateful for the gift of tax indexing

By Wil Armstrong Your biggest Christmas present of the year may be one you won’t even notice! The legendary 1981 Reagan tax cut — which ushered in a decade of prosperity — included a little-known provision called tax indexing. It put an end to inflation pushing Americans into higher tax brackets. Though it did not…

-

20,000 Colorado taxpayers eligible for $8 million in unclaimed refunds

The state of Colorado has started sending notices to an estimated 20,000 taxpayers who may be eligible for a total of $8 million in unclaimed tax refunds. The notices, which will be sent out through June 30, 2026, are part of an effort by Gov. Jared Polis, the Colorado Department of Revenue, the New Practice…

-

Colorado bingo nonprofits don’t always tell the IRS what they tell the state, some say nothing

Editor’s note: This is the last in a three-part series examing Colorado’s $110 million charitable gaming industry. Colorado nonprofits that rely on charitable gaming to raise funds – most through bingo nights – are required to file regular financial reports with state regulators that track how much money comes in, how much goes out and…

-

EDITORIAL: Propositions LL & MM — good money after bad

As if Coloradans needed another reason to vote against the tax hikes of Propositions LL and MM — placed on this November’s ballot by our free-spending legislature — a new analysis released this week provides as good an argument as any. The Common Sense Institute’s latest report on the subject reminds us the fundamentally misguided…

-

Will Colorado courts curb lawmakers’ backdoor taxes

During its August special session, the Colorado General Assembly passed several bills to raise tax revenue and partially fill the growing chasm between federal tax policy and progressive Democrats’ insatiable spending. Although the Taxpayers Bill of Rights (TABOR) in our state constitution requires a public vote on any “tax policy change directly causing a net…

-

Colorado’s fiscal future continues to be clouded by tariffs, revenue drops and recession fears

State economists on Monday presented continuing data that shows a weakened economic outlook for Colorado and continued risks for a near-term recession. The Joint Budget Committee, comprised of six lawmakers from the General Assembly who annually craft the state budget, saw at least some encouraging signs. The committee’s four Democrats lauded last month’s special session,…

-

Ballot measure seeks tax hike for higher income earners in 2026

A coalition led by a Colorado think tank will file a ballot initiative on Wednesday to raise state income tax rates on annual household incomes and corporations with earnings above $500,000. The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.…