Risky business: Modern-day gold rush lucrative for sellers, opportunity to buy for others

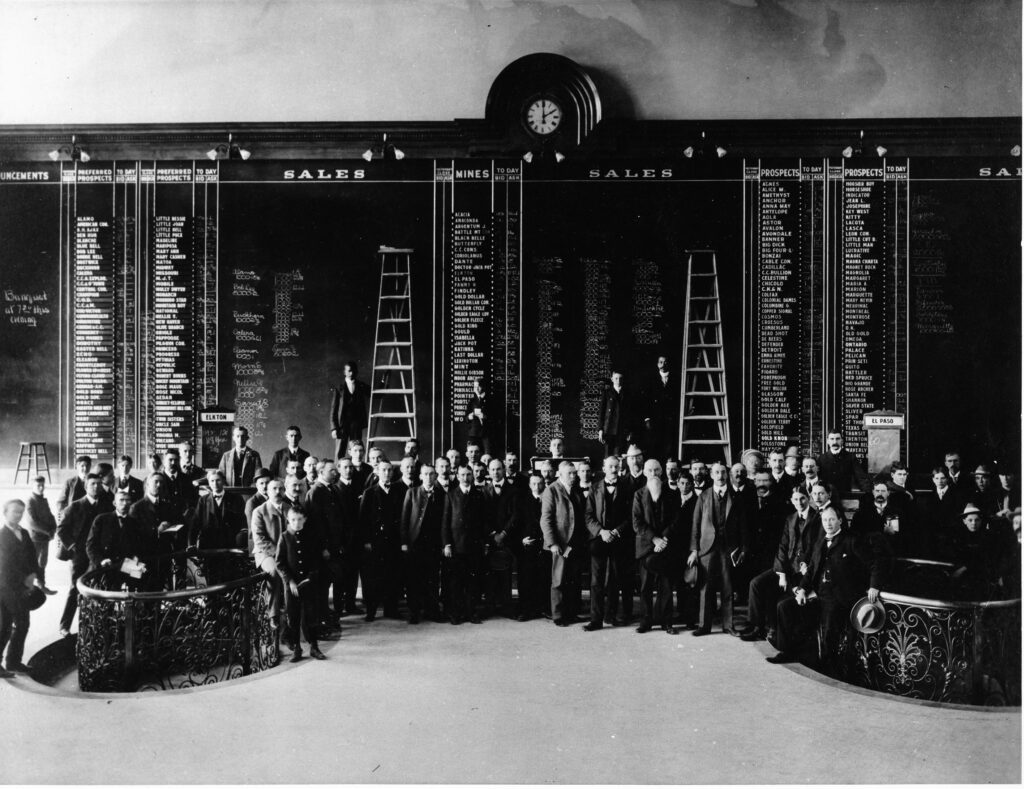

The world’s richest gold rush that began in 1891 in what became the Cripple Creek Mining District created endless lines of mined ore carts slogging down the mountain to smelting and milling operations in Colorado Springs.

The current gold rush that started six months ago has produced steady lines of people at businesses that buy and sell gold, silver and other precious metals.

At either time in history, there are winners and losers.

For several months, the days for the employees and three generations of the Hallenbeck family, who own Hallenbeck Coin Gallery on North Nevada Avenue, have seemed as long as the queues of customers standing outside the front doors.

“It’s almost a frenzy,” Tom Hallenbeck said a few days ago, stealing a few minutes to talk about what he’s seeing. His family runs the largest such store in town and is the only full-time coin and bullion dealer.

“It is a version of the modern gold rush,” he said. “The amazing thing is people are buying at these prices, too, and we’re having to educate them about what is an ingot, a coin, a bullion.”

Gold prices started rallying in April, surpassing $3,500 per troy ounce on the spot market, and on Oct. 20 hit an all-time high of nearly $4,400 an ounce. Silver peaked at $54.47 an ounce on Oct. 17.

The prices have dropped some since then but remain historically high.

Every day, people from first-timers to old-timers stand patiently waiting their turn to enter Hallenbeck’s and cash in on jewelry, coins, cutlery and household items with precious metal content, even gold teeth.

As a result, volume is up between 30% and 50% across the board, Hallenbeck said. “We’re so far behind, we had to change our hours to give us an extra half hour in the mornings to get things done.”

Awareness is driving the market’s rally, he said. “Many people are looking for an alternative investment. A lot of people feel very confident having a tangible, liquid asset.”

What’s happening?

Several factors are at play, said Colorado Spring economist Tatiana Bailey, executive director of Data-Driven Economic Strategies.

Geopolitical tensions, economic uncertainty, trade wars, tariffs and interest rates all can influence the precious-metals market. But a main consideration, Bailey said, is that the weakened value of the U.S. dollar has reduced confidence.

“Traditionally, people think of stock prices and precious metals going in opposite directions, and gold and silver are considered a safe haven,” she said. “If the economy isn’t very strong, and maybe the dollar – the world’s reserve currency – is not very strong, they turn to something else. They’re hedging that risk.”

But at this point, the stock market and precious metals are moving in the same bullish direction.

That’s concerning, though, for Bailey and others in the industry.

“Significant headwinds,” such as inflation ticking up and changes to tariffs, are eroding the dollar, she said. And investors are paying attention.

“A lot of the reason gold is rallying is it’s a hedge to say things aren’t as rosy in the U.S.,” Bailey said. “Inflation is not just an American problem; we’re the world’s largest importer.”

Buyers of gold include central banks, the Federal Reserve, even banks from developing countries, according to Bailey. They aren’t just buying ounces, either. They’re literally buying tons. “That’s driving the demand that’s driving up the price.”

Sales of silver include another factor: it’s needed to build solar panels, which has become a booming global market.

Whether the Federal Reserve remains independent is also a factor.

“If it’s not independent and there’s continued push to keep interest rates low, that means the interest rate is not going to be worth as much, which takes away some of the integrity of the U.S. dollar. That devalues the investments in U.S. dollars,” Bailey explained.

Such elements led to the major banks across the world releasing a statement that they don’t think gold is suddenly going to crash. They believe gold prices will remain consistently high – for at least the next few quarters and perhaps another couple of years.

“Which is a pretty long time, but it kind of makes sense,” Bailey said. “We’d be surprised if we turned on the news to hear things have settled. There’s so much going on that the integrity of the U.S. dollar is being questioned.”

Gold mining then and now

Retired mining engineer Roger Johnson has fond memories of riding his mountain bike home to Colorado Springs in the summer when he worked at the Cripple Creek and Victor Gold Mine in Victor from 1997 through 2003 as the company’s processing manager.

A School of Mines educated metallurgical engineer, Johnson would follow the old train track bed known as the Short Line railway route. Since 1936 it’s been Gold Camp Road, a publicly accessible, winding dirt road that’s considered the back way from Victor to Colorado Springs.

During the largely downhill two-hour trek on his bike, Johnson sometimes thought about how the early miners were ingenious in their quest to make money.

“I marvel at the courage and determination and drive it took to do what they did: travel West and stake everything on finding and mining ores at locations that were sometimes at 11,000 feet or higher,” Johnson said. “It was back in a time when the West was expanding, and there were many opportunities.”

Early-day mining pioneers faced unthinkable challenges and a lot of unknowns, he said, and many went bust. But you don’t hear that much about them.

“It was risky business,” Johnson said. “For every Penrose and Stratton (who made fortunes), there were hundreds that lost their shirts.”

Entire towns disappeared, and some, like Victor, saw their heyday in the late 1800s and early 1900s and today are small and quiet. Though surface mining continues at the Cripple Creek and Victor Gold Mine.

While technology has advanced the mining industry immensely, the basics of the trade remain the same, Johnson said.

“You still have to have an ore body, which means you have to discover and find economic grades of gold ore,” he said. “You have to mine it and figure out how to get values out of the ore.”

However, safety practices and environmental stewardship are vastly different from the 19th century, largely because civilization has progressed.

“We understand a lot more about the impacts, compared to the old-timers,” Johnson said. “They were just trying to eek out a living.”

In addition to the mine in Victor, Johnson worked at others around the world, including the Climax Mine near Leadville. He retired in 2018.

When he worked at the mine in Victor, gold was selling for around $300 an ounce.

“So, more than $4,000 is eye-popping,” he said. “But if you look at how gold has appreciated over the last 10 years and what the stock market has done, the S&P 500 and the price of gold have changed about the same.”

Mining is still a gamble, Johnson said. As a commodity tied to speculation, the price of gold is volatile, and wild swings aren’t uncommon.

“It’s always been a risky business, and I don’t see that changing,” he said.

Winners and losers

Whether investors bet for or against the U.S. dollar and economy will determine who will strike it rich in the current gold rush.

Those who invest in gold will benefit from economic underperformance.

“Those investors would have protected their assets in gold, while much of the rest of the world is holding U.S. dollars that are not worth as much as they used to be,” Bailey said. “In this scenario, the losers would be those who did not mitigate their risk by buying gold.”

Alternatively, people who largely ignore the gold rally because they believe the U.S. dollar and economy will stay strong, would “win” if they are right, according to Bailey.

“The U.S. dollar is low right now, and if it gains strength and the U.S. economy and stock market are strong, those investors will be holding dollars that are worth more in the next few quarters,” she said.

Hallenbeck said one couple who recently came to his store had just sold their house and spent all the profit they made on buying gold. “We live in interesting times,” he said. “Gold is becoming more mainstream.”

Some of the items he purchases from customers, such as old class rings, wedding rings and out-of-date jewelry, as well as coins and other pieces will be melted, Hallenbeck said.

Behind-the-scenes analysis aside, most people in line outside Hallenbeck’s store in recent days wanted to sell items and were happy thinking about having a little extra money in their pockets.

The high prices of precious metals didn’t motivate Aaron Bly to wait his turn.

“It’s just an old present I got that I want to sell now,” he said.

A couple named Don and Julie, who didn’t want to provide a last name, said their dentist recommended they sell a removed crown. Jeff Winemiller wanted to find out how much an old bucket of coins he had was worth.

Another customer, Remi, who declined to give her last name for privacy reasons, said she’s a reseller and recently found a gold necklace in a pocket of clothing she had purchased.

She brought it to Hallenbeck’s and walked out with about $2,000.

“It was a real surprise, a real treat,” Remi said.